Home : Research Results : 9% support lowering corporate tax

Research Results

9% support lowering corporate tax

19 Mar 25

While the government is considering lowering corporate tax, a new survey finds only 9% of adults support this, while 25% want it increased.

A new Horizon Research survey finds the most popular tax reform would be increasing the amount of personal income before it starts getting taxed.

Some parties are reportedly considering introducing wealth and capital gains taxes. Around a third of adults support these.

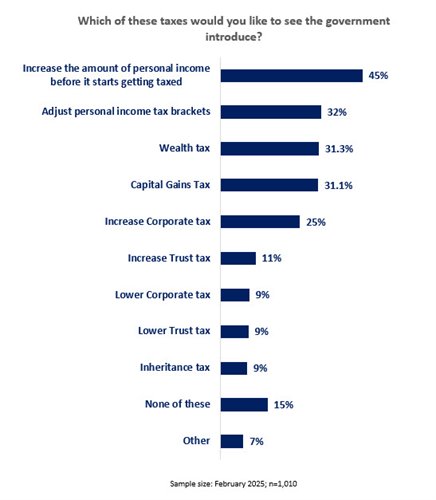

Survey respondents were asked Which of these taxes would you like to see the government introduce?

The key findings are:

45% (equivalent to round 1,747,000 adults) would like to see the government increase the amount of personal income before it starts getting taxed

32% (1,237,000 adults) think personal income tax brackets should be adjusted.

31.3% (1,210,000 adults) think the government should introduce a wealth tax.

31.1% (1,202,000 adults) think Capital Gains tax should be introduced.

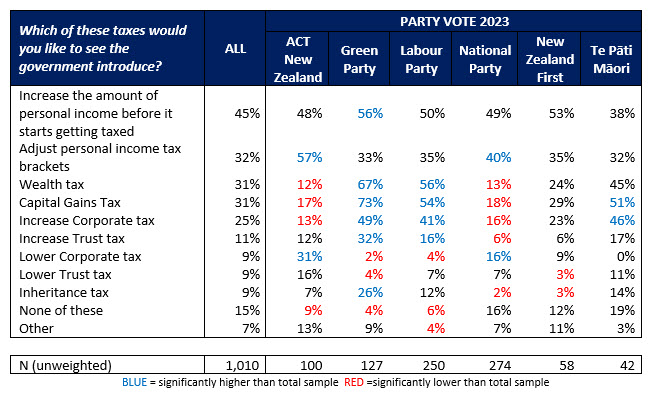

National voters evenly split on corporate tax

As the government reportedly considers lowering corporate tax in the May 2025 Budget, in a bid to increase economic growth, the survey finds that among those who voted for the National Party at the 2023 general election, 16% want corporate tax lowered – and 16% want it increased.

Strongest support for lowering corporate tax comes from ACT voters (31%). 13% of ACT voters are for increasing corporate tax.

Among voters for the other coalition government party, New Zealand First, 23% want a corporate tax rise and 9% a cut.

Voters for the Green party (49%), Labour (41% ) and Te Pāti Māori (46%) want a corporate tax rise.

25% of business proprietors, managers and self-employed want a corporate tax cut along with 17% of business managers and executives. 16% of business managers and executives support a corporate tax rise, along with 19% of business proprietors and self-employed.

Results by party vote are:

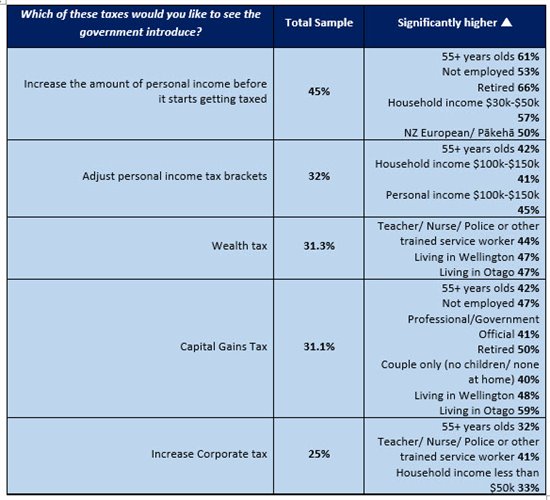

Who supports the top 5 most favoured tax reforms

For the top 5 taxes, the table below shows the groups which are significantly more likely to want them introduced.

Taking action on taxation this year ranks 27th out of 37 policy areas New Zealanders want the Government to take action on in 2025, Horizon polling finds.

Survey methodology

Research method

An online survey of adults living in New Zealand aged 18 and older.

Sample sources

Members of two nationwide Horizon Research panels and a third-party panel (used for source diversity).

Fieldwork dates

20th to 25th February 2025.

Sample size

1,017 adults.

Weighting

The total sample is weighted on age, gender, ethnicity, region and party vote at the 2023 general election to reflect the New Zealand adult population.

Maximum predicted margin of error

±3.1% at the 95% confidence level.

Population estimates in the report

These are based on the Stats NZ Census 2023 population of 3,865,235 people aged 18 or more. All population numbers are to the nearest thousand.

The survey was self-commissioned by Horizon as part of its public interest research programme, which aims to make New Zealanders heard by those making decisions which affect them. Horizon is a member of the Research Association New Zealand and follows its online research rules and guidelines.

Contact:

For further information please contact Graeme Colman, Principal, Horizon Research, email gcolman@horizonresearch.co.nz, telephone +64 21 848 576.

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand